For the third consecutive month, the median sales price for homes in Ada County decreased year-over-year. In January, the median sales price of homes was $487,495 — down 9.7%, or $52,500, compared to January 2022. The last time that the overall median sales price was under $500,000 was in July 2021.

Both the existing/resale segment and new construction segment saw year-over-year declines in median sales price, with the biggest drop in new construction. The median sales price for new homes that closed in January was $494,990, a decrease of 16.0%, or $93,955, compared to the same month a year ago. The median sales price for new homes hasn’t been under $500,000 since April 2021.

Sales were also 32.8% lower for the county compared to last year, with a total of 454 closed sales in January 2023. Of those, 269 were existing/resale homes, down 41.5% from January 2022, and 185 were new construction homes, down 14.4% from last year.

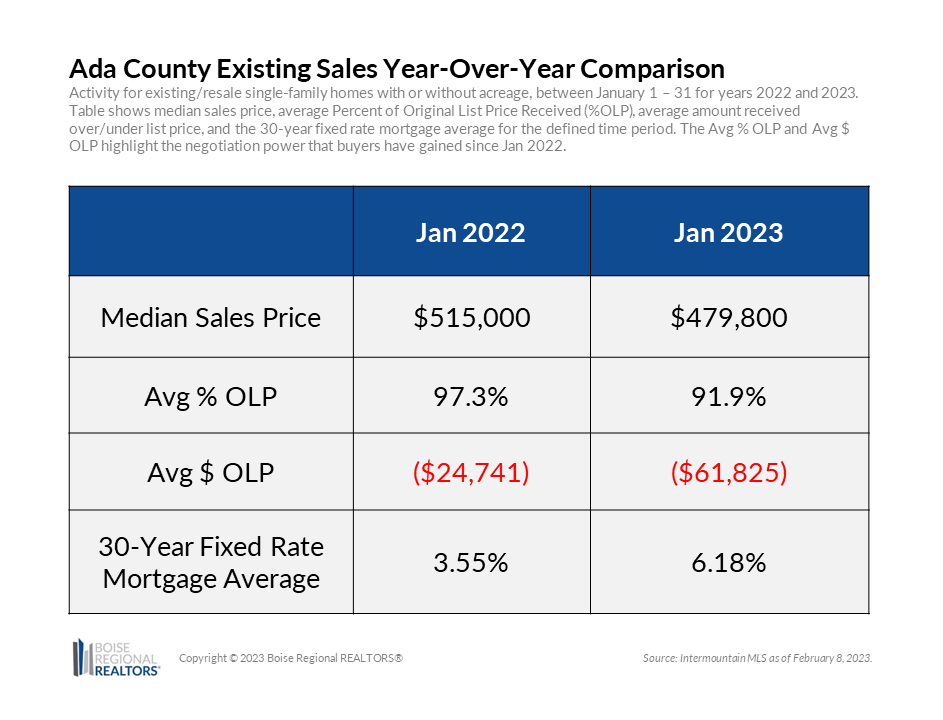

Demand for housing waned as higher mortgage interest rates and swift home price appreciation put pressure on affordability. Since the housing market continues to be driven by supply versus demand, sellers are having to adjust prices and negotiate with buyers to close the deal. The average Percent of Original List Price (% OLP) Received for existing home sales last month was 91.9%, which means on average, buyers paid 8.1% less than asking, compared to last year, when the % OLP for existing homes was 97.3%. On average, existing homes that closed last month sold for approximately $60,000 less than the original list price.

Will prices and sales continue their downward trend? Newly pending sales data, a forward-looking metric, could indicate that demand bottomed out and is beginning to recover. For the last two weeks, we’ve seen new contract signings up year-over-year. We’ve also heard from members that they’ve experienced increased interest from both buyers and sellers. This uptick in activity, as well as the stabilization of mortgage interest rates, is a positive sign as we gear up for our spring market.

Today’s buyers have more negotiation power, more options to choose from, and more time to make a decision. There were 1,169 homes available on the market at the end of January, compared to 441 for the same month last year. This increase in supply is also putting downward pressure on home prices. Market times have slowed as well, and homes that closed last month spent an average of 71 days on the market before going under contract — nearly twice the average time that homes spent on the market in January 2022.

Those looking to sell their home in the coming months need to ensure their expectations are in line with what’s happening in the market. The days of a listing going under contract in a matter of hours for well over the asking price are over. You may receive multiple offers, but it’s less likely that you’ll receive more than asking. Work closely with your real estate agent on your pricing and marketing strategy in order to reach your goals.

If you have any questions regarding the current state of the market, our team at Oliver O’Gara Real Estate is always happy to share our thoughts and expertise. Contact us at your convenience.

**The data reported is based primarily on the public statistics provided by the Intermountain MLS (IMLS), a subsidiary of Boise Regional REALTORS® (BRR). These statistics are based upon information secured by the agent from the owner or their representative. The accuracy of this information, while deemed reliable, has not been verified and is not guaranteed.